2024 Electric Vehicle Tax Credits Explained [+ EV Tax Credit Calculator]

September 1, 2023

Use this electric vehicle (EV) tax credit calculator to determine how much you could save when buying.

This is the only calculator that determines qualifying federal and state-level EV incentives based on:

- the very latest government regulations (released in April 2023)

- changing, real-time data on qualifying manufacturers, models, and incentives in all 50 states

- whether you are eligible based on your specific purchase and income requirements

Electric Vehicle Tax Credit Calculator

You can also view specific details on the Federal EV Tax Credit at fueleconomy.gov. However, always consult a tax professional to review your specific tax situation and confirm eligibility.

Table of Contents

Steve Birkett is an electric vehicle advocate based in Greater Boston, Massachusetts. He is a content creator and marketing professional who contributes written and recorded pieces to a wide range of media outlets. His analysis has been featured in Find The Best Car Price, WWLP TV, and Torque News, among others. He has also had video content featured on Inside EVs. Birkett was an EV Guide for Plug in America events in Massachusetts (Drive Electric Cambridge and Drive Electric Lowell) and Ohio (Earth Day 2019 at Cleveland Zoo). He participates in quarterly advisory panel meetings for EVolve New York (a state-level charging initiative) and has contributed to focus groups for prominent U.S. charging networks.

Birkett is a father-of-two who loves nothing more than packing up the family and hitting the road in their latest electric car, which is currently a 2022 Hyundai IONIQ 5. With multiple Chevy Bolts in his past, as well as a Chevy Volt and Tesla Model 3 LR in the extended family, plus various EV rentals when he ventures back home to his native United Kingdom, Birkett has more than 100,000 all-electric miles under his belt and is always ready to try out a new electric vehicle.

For press inquiries, contact steve@findthebestcarprice.com

The EV tax credit offers $7,500 per consumer. But the rules and regulations will impact how much you can save.

Last Updated: January 2024

Understanding the EV Tax Credit (Video)

Want to learn more about EVs beyond just tax credit savings? Check out our YouTube course to see if an electric vehicle is right for you >>

How Does the EV Tax Credit Work?

A federal EV tax credit program offers a maximum tax credit of $7,500 in incentives when you buy a qualifying EV, depending on your personal circumstances. The type of vehicle you choose and your tax burden impact how much of the federal incentive you can access. Additionally, the vehicle you buy must have a battery with a capacity of at least 7 kWh, along with meeting other criteria.

Qualifying electric, hydrogen, and plug-in hybrid vehicles placed into service from 2023 onwards are eligible for the federal tax credit for new clean vehicle purchases. A separate tax credit of up to $4,000 is in place for purchases of used clean energy vehicles sold for less than $25,000.

Since the incentive is not a tax rebate yet, you can claim only as much credit as your tax liability in that year. This is expected to change in 2024, but currently, the amount you save depends on your tax burden.

Eligibility Requirements

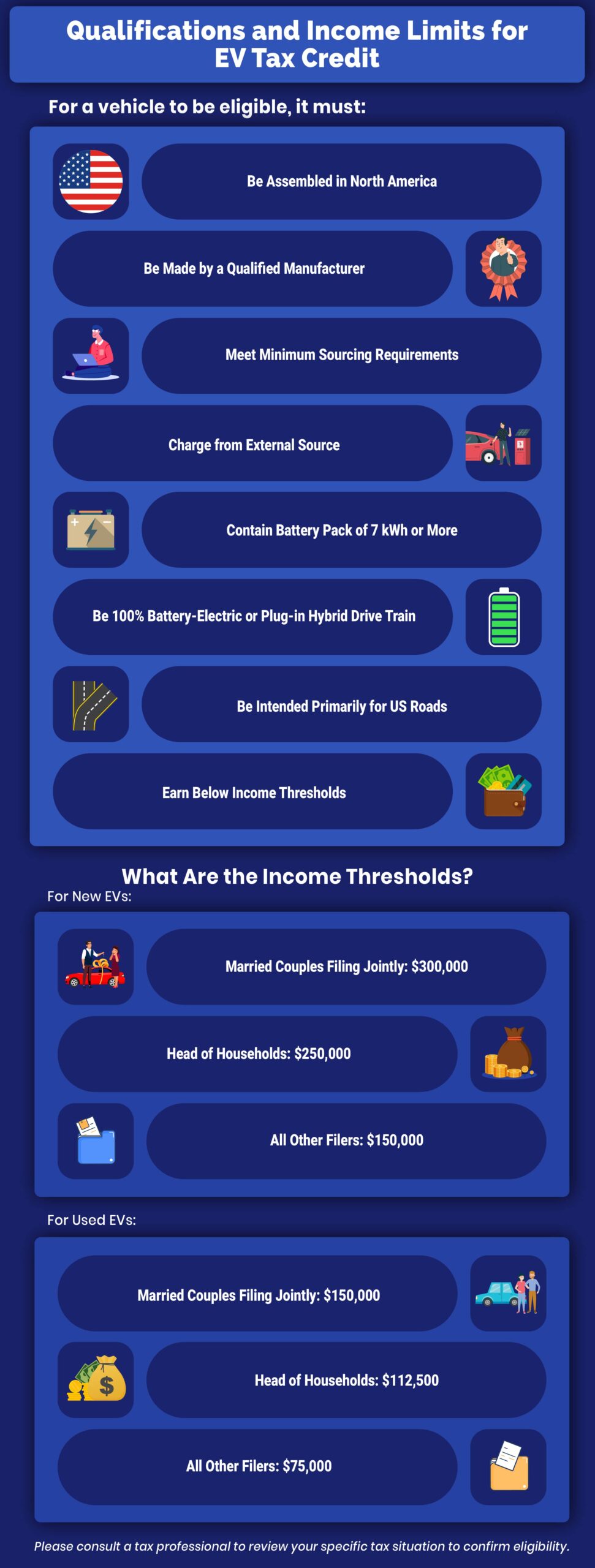

There are some key qualifying criteria that vehicles must meet for different aspects of the federal tax credit. For a vehicle to be eligible, it must:

Be assembled in North America

Be assembled in North America- Be made by a qualified manufacturer and meet minimum sourcing requirements for battery components and critical minerals

- Charge from an external source.

- Contain a battery pack with a capacity of 7 kilowatt hours (kWh) or more.

- Be 100% battery-electric or have a plug-in hybrid drive train.

- Be intended primarily for use on US roads.

- Earn below set income thresholds.

EV Tax Credit Income Limits

The federal tax credit for electric vehicles is only available to buyers earning below its income qualification caps. Note that the income limits are different depending on whether you are buying a new EV or a used one.

Following updates in 2023, the current EV tax credit income limits for buying a new and used electric vehicle are as follows:

| Married Couples (Filing Jointly) | ||

| Head of Households | ||

| All Other Filers |

How to Claim the $7,500 EV Tax Credit

The list of electric vehicles qualifying for the new federal EV incentives is constantly updated. Manufacturers add new models and shift production to North America. Use our EV incentive calculator above to find the latest qualifying models and check if your chosen EV is eligible.

Since the federal EV incentive is a tax credit, you do not get it immediately upon purchasing the EV. You apply for the EV federal tax credit when filing your taxes for the year you bought the vehicle. For instance, if you buy a new EV in May 2023, apply for the credit with your 2023 taxes in early 2024.

You must fill out IRS Form 8936 when filing your annual income tax returns. Keep in mind that not all online or software-based tax systems support this form.

Does the EV Tax Credit Apply to Used Cars?

A separate incentive from the new clean vehicle federal tax credit exists for used EV purchases. This provides qualifying buyers with a credit of up to $4,000 when purchasing a used EV priced below $25,000.

For a used EV to qualify for this credit, it must:

- Be purchased on or after January 1, 2023

- Be purchased for personal use, not resale

- Be more than two years older than the current model year

- Have a gross vehicle weight rating below 14,000 lbs

- Have a battery capacity of at least 7 kWh

- Be sold via a licensed dealership

- Not have already claimed a used EV tax credit

Does the EV Tax Credit Apply to Leased Cars?

Only the vehicle’s titleholder can claim the EV tax credit. While leasing an EV is great for the environment and allows you to upgrade to newer technology every few years, you will not be able to claim the EV tax credit directly. Some lenders will factor in the tax credit to the monthly payment calculations, which would allow you to absorb some of the benefit of the tax credit in the form of lower monthly payments.

State EV Tax Credits

In addition to the federal tax credit, electric vehicles may also qualify for local and state incentives. Of course, the amount and type of incentives available to you depend on the programs offered in your state. In some cases, the state incentives can be combined with the federal incentive program for a $12,500 in savings on the cost of purchasing an EV.

Some of the potential incentives you can get from your state or local government include:

- Grants

- Tax incentives

- Loans and leases

- Rebates

- Exemptions

- Utility discounts

- Discounts on home charging equipment

You should check for your local incentives before purchasing the EV to make sure you know all of your options and the qualification requirements for each of the incentives. While the federal tax credit does not apply when leasing vehicles, some state incentives do. For example, Colorado offers up to a $5,000 tax credit for the purchase or lease of a new EV.

How to Claim Your State's EV Tax Credit

Each state has its own EV incentives and process. The incentives and process can vary drastically among states, so be sure to research how to claim the EV state incentive for your state.

How to Claim the California EV Rebate

California offers several incentives, including a $7,000 grant based on income eligibility, a $1,500 California Clean Fuel Reward, discounted charging rates during off-peak hours, rebates for level 2 installation, and free charging for one year based on region.

Due to California EV rebates' high cost and popularity, they installed an income limit of $150,000 for an individual or $300,000 for joint filers. Plug-in hybrids with electric ranges under 35 miles or EVs with a base price above $60,000 are not eligible. The California rebate is cash or a check at the point of sale. A mailed check may take up to 18 months to arrive.

To learn more about the process and apply for a rebate, head to California’s Clean Vehicle Rebate page.

Charging Infrastructure Incentives

Some utility companies and communities also provide EV incentives. Purchasing an electric car may earn you cash back, credits, or a discounted rate plan. In states like Arizona, California, and Hawaii, electric companies offer EV owners reduced rates based on time of use. If you join their programs and share data from your charging devices, some utilities offer discounts on home EV charging equipment.

Buying an EV is a great investment for your wallet and our planet. Various incentives help reduce the initial cost of buying an electric vehicle. Before purchasing an EV, use the above resources to determine all federal, state, and local incentives you qualify for.

EV Tax Credits, Incentives, & Rebates by State

Look below to find your state's EV tax calculator and available local and utility incentives.

Qualified Electric Vehicles

The federal electric vehicle tax credit (up to $7,500) is based on the vehicle’s assembly and the components of its battery pack.

The federal tax credit only reduces your tax liability. For example, even if a vehicle qualifies for the full $7,500 and you owe $5,000 in taxes, it will only credit the $5,000. You will not receive the rest of the credit of $2,500

| Make | Model | Amount |

| Cadillac | Lyriq | Up to $7,500 |

| Chevrolet | Bolt EUV | Up to $7,500 |

| Chevrolet | Bolt EV | Up to $7,500 |

| Ford | E-Transit | Up to $3,750 |

| Ford | F-150 Lightning | Up to $7,500 |

| Ford | Mustang Mach-E | Up to $3,750 |

| GMC | Hummer EV | Up to $7,500 |

| Lucid | Air | Up to $7,500 |

| Rivian | R1S | Up to $3,750 |

| Rivian | R1T | Up to $3,750 |

| Tesla | Model 3 Performance | Up to $7,500 |

| Tesla | Model 3 LR | Up to $7,500 |

| Tesla | Model 3 SR | Up to $7,500 |

| Tesla | Model Y | Up to $7,500 |

| Tesla | Model Y Performance | Up to $7,500 |

| Tesla | Model S | Up to $7,500 |

| Tesla | Model X | Up to $7,500 |

| Volkswagen | ID.4 | Up to $7,500 |

Qualified Plug-in Hybrid Vehicles

If a PHEV meets the same requirements as described above for battery electric vehicles (BEV) and has a pack capacity of more than 7 kWh, it may qualify for the full federal tax credit of $7,500

Used our incentive calculator to find out if the PHEV model that you are considering is among those that qualify.

| Make | Model | Amount |

| Chrysler | Pacficia | Up to $7,500 |

| Ford | Escape | Up to $3,750 |

| Jeep | Grand Cherokee 4xe | Up to $3,750 |

| Jeep | Wrangler 4xe | Up to $3,750 |

| Lincoln | Aviator Grand Touring | Up to $7,500 |

| Lincoln | Corsair Grand Touring | Up to $3,750 |

Frequently Asked Questions

Do car manufacturers offer incentives on EVs?

Yes, in addition to federal EV tax credits and local state incentives, some automakers offer incentives on their electric vehicles. These EV incentives vary month-to-month when it comes to cashback, financing and lease deals, while longer-term incentives such as complimentary charging or assistance installing a home charger may also be available. Check out the best EV deals for this month.

Do hybrid cars qualify for the tax credit?

Yes, some plug-in hybrid electric vehicle (PHEV) models with battery capacities greater than 7 kWh qualify for the federal tax credit. Use our calculator to see which PHEVs you can consider.

Is there an income limit for the EV tax credit?

Yes, the following income caps apply to the federal EV tax credit and the new credit for used electric vehicles. Married/Joint Filers = $300K for New / $150K for Used. Head of Households = $225K for New / $112,500 for Used. All Other Filers = $150K for New / $75K for Used.

What cars qualify for the federal tax credit?

Many different EVs qualify for the EV tax credit, as long as they are assembled in North America and meet sourcing requirements for battery components and minerals. Some examples include the Cadillac Lyriq, Ford 150 Lightning, and the Tesla Model 3.

Are electric vehicles tax-free?

No, you still have to pay the sales tax on the purchase of an EV vehicle. However, you may be eligible to get a tax credit on your income tax for that year. In addition, some states may charge extra fees to EV drivers due to declining gas tax revenue.

How does the phase-out work for EV tax credits?

Although the previous federal tax credit for electric vehicles included a phase-out period that was triggered once an automaker sold 200,000 EVs, the current legislation includes does not. The Inflation Reduction Act instead specifies manufacturing, sourcing, and assembly criteria that qualify or exclude certain automakers and models, rather than a blanket tax credit expiration based on the number of electric vehicles sold.

Posted in Car Buying Tips, Electric and Hybrid Vehicles |