47 Car Loan and Repossession Statistics for 2024

January 20, 2024

I am a serial entrepreneur and a consumer advocate. When I’m not helping car buyers, I love working on ventures that have a positive impact.

I run a cause marketing agency and serve on the board of Vayu Global Health where we are disrupting the medical industry and preventing the needless deaths of mothers and babies during childbirth.

Explore the key facts and figures about car loans and repossession rates.

Get insights into current loan terms, borrower behaviors, and the reasons behind increasing or decreasing repossession rates.

Whether you're considering a car loan or just want to stay informed, our set of stats will provide you with a detailed overview of the car loan and repo landscape in 2024.

Table of Contents

Need an expert quote for your story? We’re happy to help. Contact our Senior Editor, Steve Birkett.

Key Car Loan and Repossession Statistics

- Americans took out an average of $59.8 billion in new auto loans each month in the third quarter of 2023.

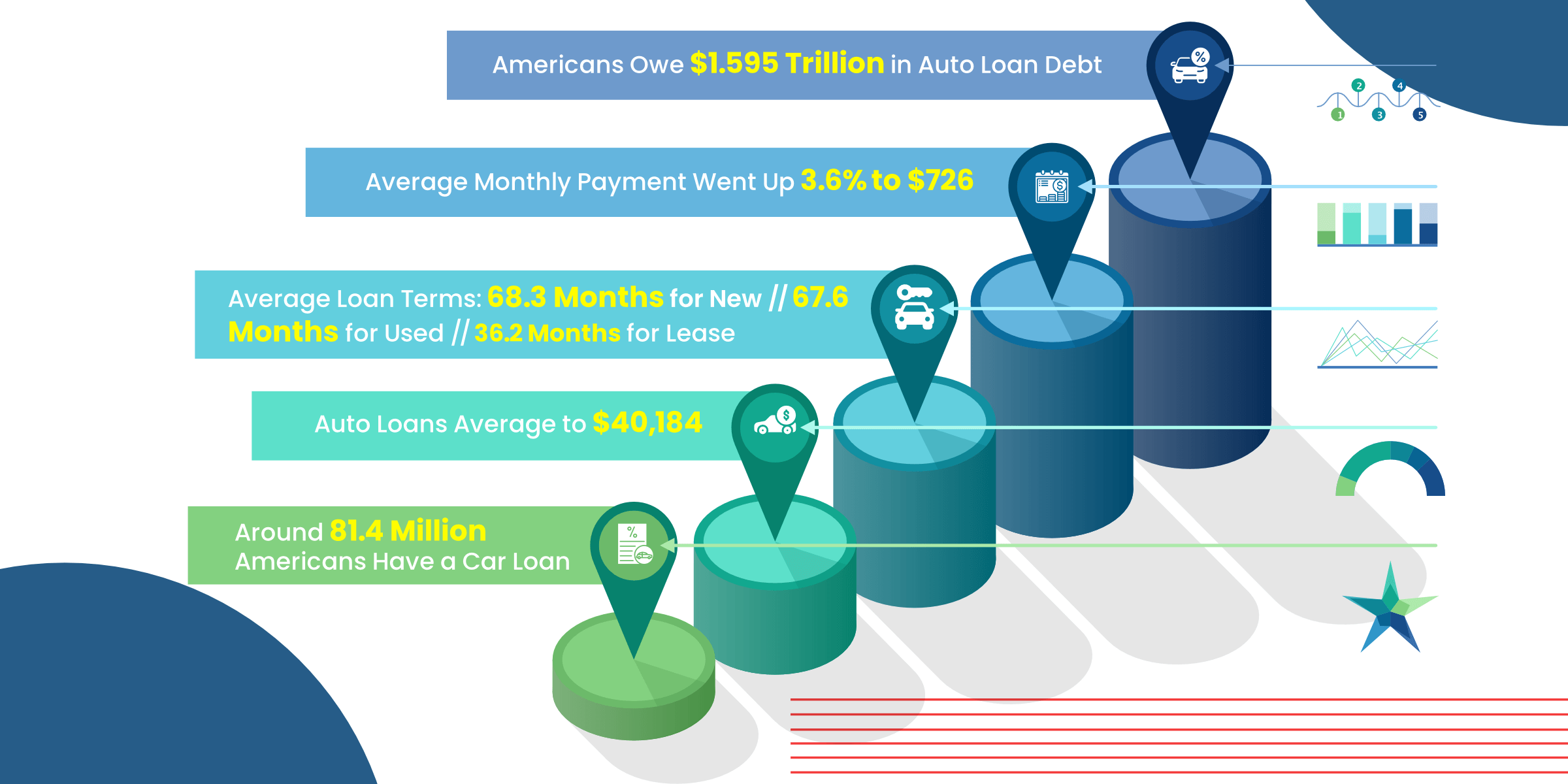

- Americans owe $1.595 trillion in auto loan debt, according to the Federal Reserve Bank of New York, which accounts for 9.2% of American consumer debt.

- As of September, 6.1% of U.S. subprime borrowers were 60 days or more behind on their car payments.

- The average monthly payment for a new car is up 3.6% since last year to $726 monthly.

- The average auto loan term is 68.3 months for new cars, 67.6 months for used cars, and 36.2 months for leased vehicles.

- Auto loans average almost $40,184 for new vehicles.

- Around 81.4 million individual American adults have a car loan.

Car Loan Payment Statistics

How much and how often are Americans paying their car loans? A lot.

Here are car loan payments by the numbers.

- Average car payments in the U.S. increased year over year by 3 to 5%, much less than the previous two years.

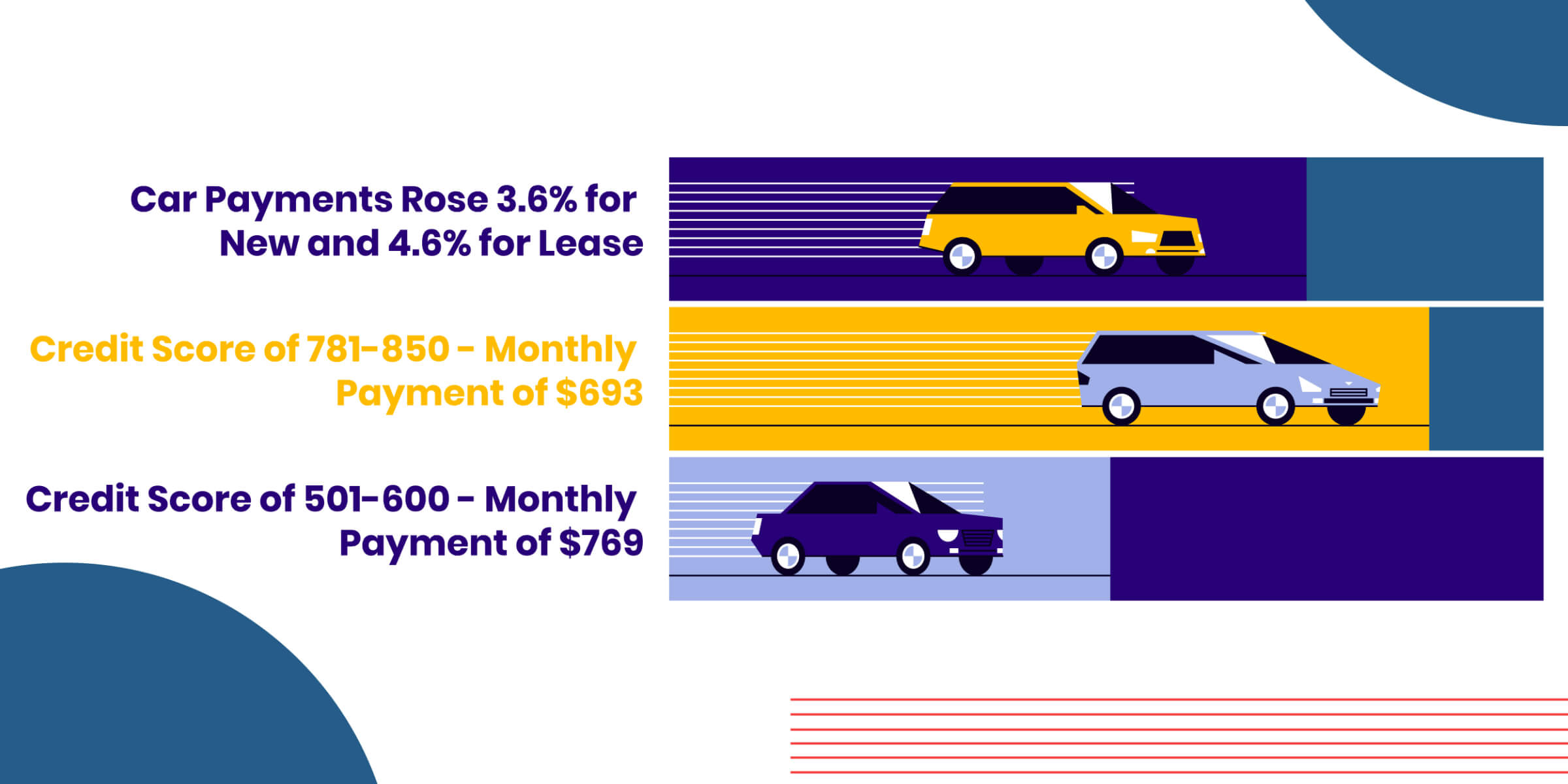

- Car payments rose by 3.6% for new vehicles and 4.6% for leased cars last year.

- Monthly car payments average $726 for new vehicles and $597 for leased vehicles.

- Borrowers with a “superprime” credit score (781-850) saw the lowest car payments at an average of $693 monthly.

- As of Q4 2023, around 17.5% of Americans with cars now pay more than $1,000 or more a month on their car note, up from 17.1% the previous quarter.

- Those with credit scores of 501 to 600 saw the highest average monthly payment for new vehicles in 2023 at $769.

Used Car Loan Statistics

Luckily, used car loan numbers have not gone up quite as much as their new car counterparts.

But they’re still not cheap.

- Americans borrowed an average of $27,167 for used vehicles, according to Experian.

- Car payments rose by .8% for used vehicles last year.

- Monthly car payments average $533 for used cars.

- Borrowers with credit scores in the prime tier (661 to 780) take out the most for used cars at $28,504.

- Car buyers last quarter paid an average interest rate of 11.2% for used vehicles.

- Used car and truck prices are down by 7.1%.

- “Buy-here, pay-here” businesses, often known for predatory lending practices, own 14.7% of the used car financing market. In the used car arena, captive lenders only claim 9.6%.

Demographics of Car Loans Statistics

Who’s taking out these car loans? Millennials and Nor’easterners.

To be more specific:

- Americans younger than 50 take out $36.6 billion in auto debt monthly.

- Americans 50 years and older take out $22.1 billion in auto debt each month.

- 38% of Millennials say they are currently making auto loan payments.

- Men are 7% more likely to be in the market for an auto loan.

- Only 24% of Baby Boomers currently have an auto loan, smaller than the 31% US average.

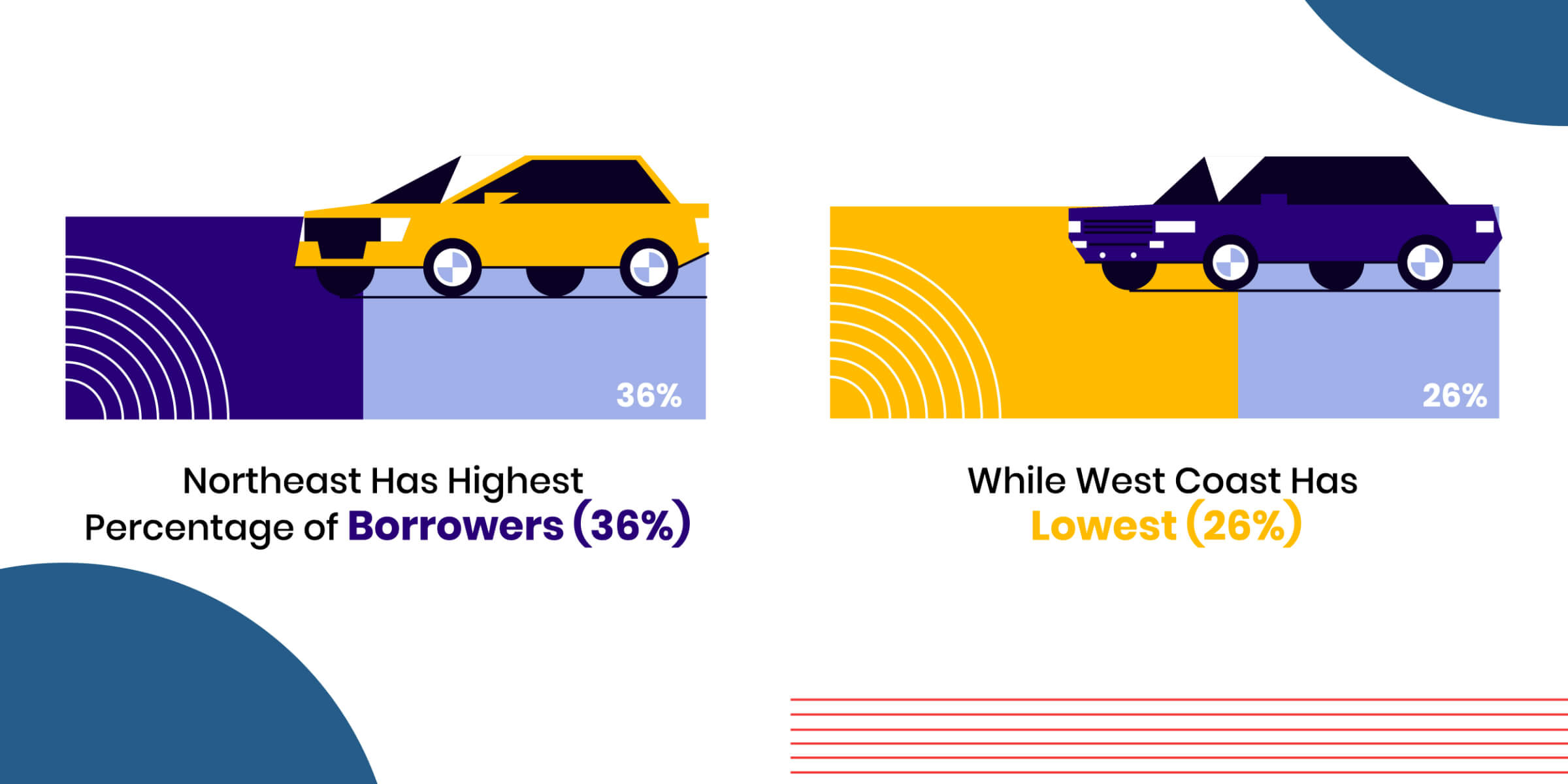

- The region with the lowest percentage of car loan borrowers is the West, with only 26% of adults saying they currently had a car loan.

- The Northeast has the highest percentage of loan borrowers, with 33% currently paying for a car loan.

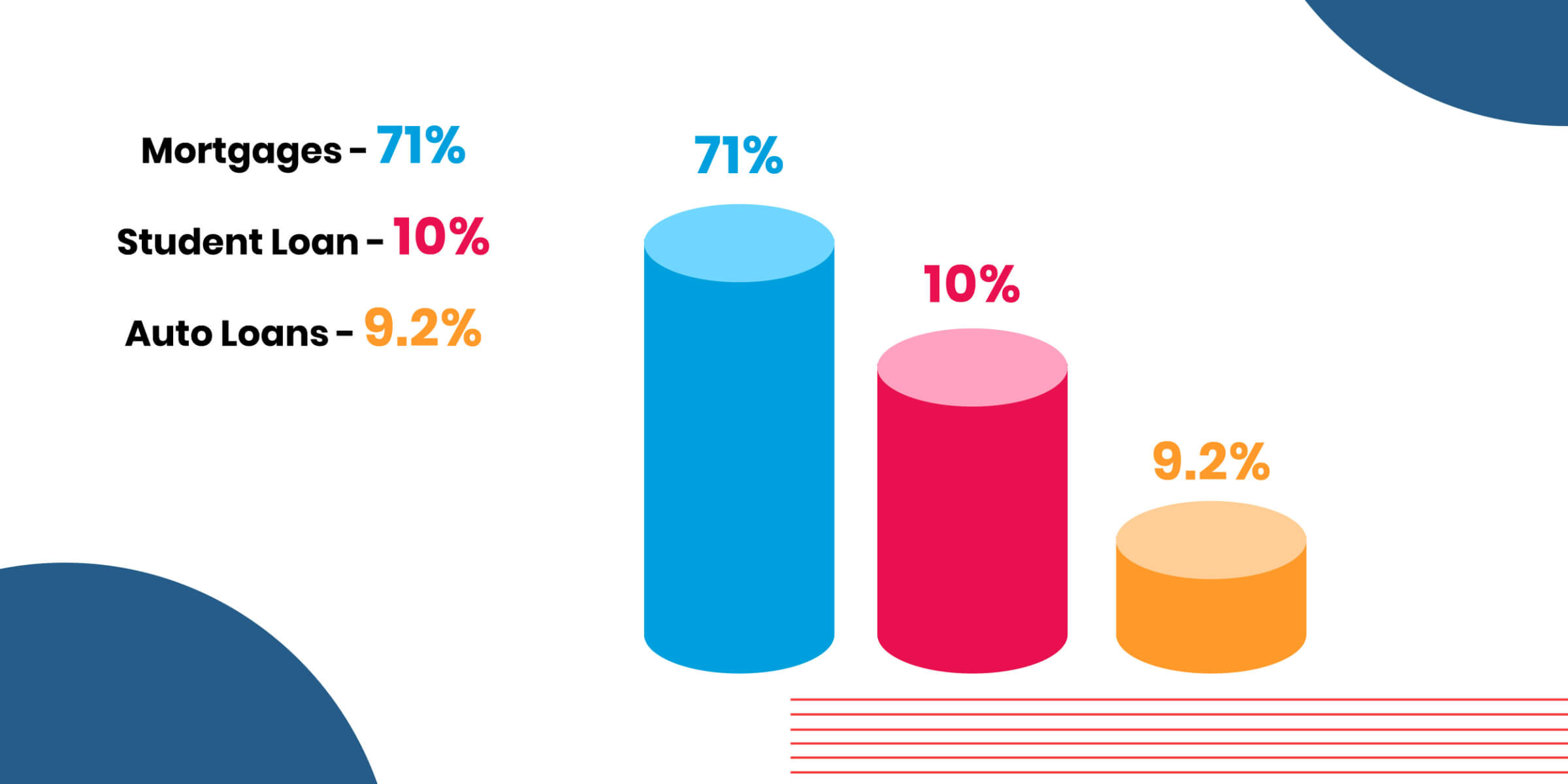

Car Loans Vs. Other Debt

Car loans have nothing on mortgages, but how do they stack up against the other leading causes of debt?

- Mortgages come in at the top of all US individual debt, making up 71% of America’s debt. This is followed by student loans at around 10% and car loans in third place at 9.2%.

- In 2022, auto loans accounted for an average of $1.595 trillion of total debt from loans, an increase from $1.52 trillion in 2022.

Car Repo Stats

Along with car loans increasing, an increase in repossessions is expected.

The numbers don’t look great right now, but experts say the repo numbers should level out in the next couple of years.

- Car repossessions are up by 20.4% compared to last year.

- Cox Automotive estimated that 1.5 million vehicles will be seized by the end of 2023, up from 1.2 million in 2022.

- The share of subprime borrowers who were delinquent (at least 60 days late on their car payments) rose to 6.11% in September 2023.

- Cox Automotive analysts predict that long-term through 2025, repossessions will remain at or below historical norms. Before then, we could see a peak.

Car Repossession Rates in 2024

- Cox Automotive estimates that 1.5 million vehicles will be seized by the end of 2023

- Borrowers are falling behind on car loan payments at the highest rate in 27 years.

- Inflation has led to rising car loan default rates, resulting in more car repossessions.

What Are the Most Repossessed Car Models?

- The Ford F-150 is the most repossessed truck model.

- The Honda Civic is the most repossessed car model.

- The Chevy Silverado is the 2nd most repossessed truck model.

- The Honda Accord is the 2nd most repossessed car model.

How Many Cars Are Repossessed Each Year?

- 2.2 million vehicles are currently repossessed every year.

- In 2017, repossessions totaled 1.8 million units.

- The average interest rate for a new car is 6.58% and 8.07% for a used car (based on a 60-month loan.)

- The rate for a new car for the same repayment term was 4.21% in 2017.

Car Repo & Car Loan Trends: Future Outlook

- While defaults are expected to increase, analysts don’t expect repossession rates to get as bad as they were back in 2008 and 2009.

- Cox Automotive analysts predict that long-term through 2025, repossessions will remain at or below historical norms. But between now and then, we could see a peak.

- Almost 17% of people who financed a new vehicle in the first three months of this year are paying $1,000 or more a month, up from 15% in January. This is a new all-time high.

- Analysts predict that auto loan delinquencies will continue to rise into 2024 and peak at about 10% before they start to fall.

Show Sources

- https://www.lendingtree.com/auto/debt-statistics/

- https://www.lendingtree.com/auto/debt-statistics/

- https://www.investopedia.com/more-subprime-borrowers-are-falling-behind-on-car-loans-as-payments-surge-8369243

- https://www.lendingtree.com/auto/debt-statistics/

- https://www.lendingtree.com/auto/debt-statistics/

- https://www.lendingtree.com/auto/debt-statistics/

- https://www.finder.com/car-loan-statistics

- https://www.lendingtree.com/auto/debt-statistics/

- https://www.lendingtree.com/auto/debt-statistics/

- https://www.lendingtree.com/auto/debt-statistics/

- https://www.lendingtree.com/auto/debt-statistics/

- https://www.foxbusiness.com/personal-finance/monthly-car-payments-rising-edmunds

- https://www.lendingtree.com/auto/debt-statistics/

- https://www.lendingtree.com/auto/debt-statistics/

- https://www.lendingtree.com/auto/debt-statistics/

- https://www.lendingtree.com/auto/debt-statistics/

- https://www.cbsnews.com/news/auto-loan-average-payments-2023-edmunds/

- https://www.investopedia.com/why-more-people-than-ever-are-paying-over-usd1000-a-month-for-new-cars-8347761

- https://www.lendingtree.com/auto/debt-statistics/

- https://www.lendingtree.com/auto/debt-statistics/

- https://www.finder.com/car-loan-statistics

- https://www.finder.com/car-loan-statistics

- https://www.finder.com/car-loan-statistics

- https://www.finder.com/car-loan-statistics

- https://www.finder.com/car-loan-statistics

- https://www.lendingtree.com/auto/debt-statistics/

- https://www.finder.com/car-loan-statistics

- https://www.nbcnews.com/politics/economics/car-repossessions-are-rise-warning-sign-economy-rcna61916

- https://www.nbcnews.com/politics/economics/car-repossessions-are-rise-warning-sign-economy-rcna61916

- https://finance.yahoo.com/news/car-repossessions-rise-danger-losing-183312724.html

- https://www.businessinsider.com/more-people-missing-car-payments-another-ominous-sign-for-economy-2023-10

- https://www.forbes.com/advisor/auto-loans/late-car-payments-heavy-loan-rates/

- https://caredge.com/guides/repo-rates-increasing

- https://www.foxbusiness.com/economy/americans-falling-behind-auto-loan-payments-record-pace

- https://www.forbes.com/advisor/auto-loans/late-car-payments-heavy-loan-rates/

- https://www.titleloanser.com/stats/car-repossession-statistics/

- https://www.titleloanser.com/stats/car-repossession-statistics/

- https://www.titleloanser.com/stats/car-repossession-statistics/

- https://www.titleloanser.com/stats/car-repossession-statistics/

- https://www.titleloanser.com/stats/car-repossession-statistics/

- https://www.bankrate.com/loans/auto-loans/rates/#what-car-loan

- https://www.cyberleadinc.com/blog/year-review-auto-loans-looked-like-2017/

- https://www.carscoops.com/2022/12/increase-in-new-car-repossessions-may-be-bad-news-for-us-all/

- https://www.kbb.com/car-news/car-repossessions-on-the-rise/

- https://www.cbsnews.com/news/auto-loan-interest-rate-march-2023/

- https://www.cbsnews.com/news/auto-loan-interest-rate-march-2023/

- https://www.businessinsider.com/more-people-missing-car-payments-another-ominous-sign-for-economy-2023-10

Best Car Deals by Category

Posted in Car Buying Tips |