Refinance Your Car Loan – Estimate Your Savings (Calculator)

May 2, 2021

I am a serial entrepreneur and a consumer advocate. When I’m not helping car buyers, I love working on ventures that have a positive impact. I run a cause marketing agency and serve on the board of Vayu Global Health where we are disrupting the medical industry and preventing the needless deaths of mothers and babies during childbirth.

See how much money you can save using this car loan refinancing calculator.

Table of Contents

Auto Refinance Calculator

This calculator provides an estimate of your car payment but accuracy is not guaranteed and may not reflect all fees and taxes.

If you are looking to determine your monthly payment for a brand new auto loan, use this calculator instead.

Why it might be time to refinance

In February 2020, according to Edmunds the average APR (annual percentage rate) on a new car loan was 5.6%. and the average used car loan was 8.3%.

The Federal Reserve made another emergency cut to interest rates, dropping the rate by 1% to a range of 0-.25%. A lower fed rate encourages lenders to offer lower rates to consumers for both new car loans and refinancing.

But aside from government moves, people simply aren’t making big purchases like new cars. As a result, auto lenders don’t have the usual volume of new car loans. This means they need to get more business elsewhere, like making refinancing deals more attractive to consumers.

Also Read:

- COVID-19 auto manufacturer financing specials

- Car discounts for first responders

- How COVID is accelerating online car buying

How much can you save by refinancing your car loan?

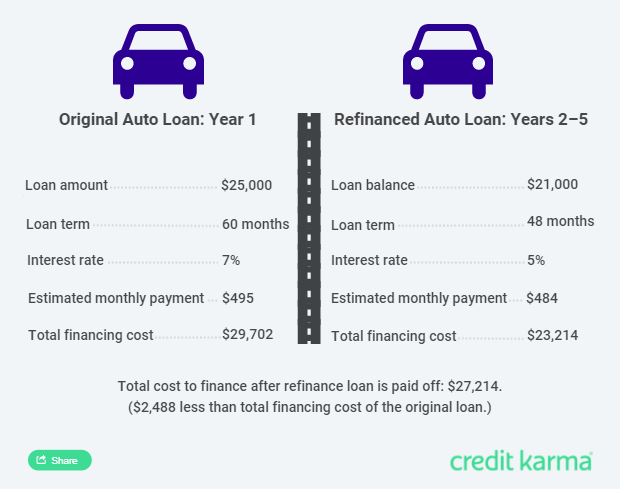

According to Credit Karma, a $25,000 vehicle financed for 60 months at 7% has a payment of $495 per month and a total financing cost of $29,702 over the life of the loan. If you refinanced $21,000 in year 2 at 5%, you'd pay about $484 per month with a total financing cost of $23,214 (for the remaining 48 months). That’s a difference of $2,488 between the two options.

When does refinancing your car loan make sense?

Here are three reasons it may be time to refinance.

Here are three reasons it may be time to refinance.

Reason 1 - If interest rates have dropped

Interest rates are always changing. So keep an eye on rates and you may be able to save some money.

A good rule of thumb is if rates have dropped 2% or more and you have at least $10,000 outstanding, then refinancing is worth considering.

Reason 2 – If you have a high interest loan

If you didn’t get a financing deal with a low APR when you bought your car you may be paying a higher interest rate than the average car buyer.

Reason 3 - If you have improved your credit

Auto lenders use your credit score to determine your interest rate. If you had a poor credit score or bought a car as a student with no prior credit history your loan payments may be inflated.

If you’ve improved your credit and have been making your car payments on time, you may now qualify for a lower rate.

Where can you refinance?

Not all lenders offer auto refinancing. However, one of my sponsors, SuperMoney, pulls together offers from those lenders that do.

They present offers from several different online lenders and you can check rates and pick the best offer.

When shouldn't you refinance?

Refinancing a car loan may not always be a good idea. You may want to hold off for these reasons.

Refinancing a car loan may not always be a good idea. You may want to hold off for these reasons.

Reason 1 - If you are towards the end of your loan

If you’ve paid off most of your car already there is less value in refinancing. Loan payments usually contain a higher portion of interest earlier in the life of the loan. As you get towards the end of the loan your payment will mostly be principal. As a result, you won’t be able to save as much on interest if you refi towards the end of your loan.

A good rule of thumb is to skip refinancing if you have less than 2 years left on your loan.

Reason 2 - If your car has high mileage

Some auto lenders will only allow refinancing if your car is less than 7 years old or hasn’t exceeded a mileage cap (likely around 100,000 miles or so). This is because the loan is secured by an asset (your vehicle) that can be repossessed if you don’t pay. The more your car has depreciated, the lower the value of the asset needed to secure the loan.

Reason 3 - If you will incur fees

Occasionally, car loans have prepayment penalties for paying them off early. If that is the case, read the fine print as the fees may exceed any interest savings.

Some lenders may also charge you fees to refinance. So again, you’ll want to evaluate any fees against the amount you will save.

Frequently Asked Questions

When should you refinance your car loan?

You should consider refinancing if you are able to get a loan with a rate that is at least 2-3% lower than your current loan.

Is refinancing your auto loan worth it?

It can be depending on your situation. A good rule of thumb is if rates have dropped 2% or more and you have $10,000 outstanding, then refinancing is worth considering.

Is refinancing your car bad for your credit?

No, in fact refinancing may help you get your finances under control. And if refinancing allows you to develop a history of on-time payments, you may actually improve your credit.

When can you refinance?

There is no minimum waiting period to refinance, you can do it anytime. Although if you are toward the end of your car loan it may not make financial sense. And lenders may not allow it if you have a very old vehicle.

What credit score do you need to refinance a car loan?

Each lender has different requirements, and while most require good credit, some go as low as 500. However, the higher your credit score the better chance you’ll have at a low APR.

Posted in Car Calculators, Car Finance |