Electric Vehicles: Survey Explores U.S. Motorists’ Views & Preferences

April 26, 2022

I am a serial entrepreneur and a consumer advocate. When I’m not helping car buyers, I love working on ventures that have a positive impact. I run a cause marketing agency and serve on the board of Vayu Global Health where we are disrupting the medical industry and preventing the needless deaths of mothers and babies during childbirth.

According to the ICCT (The International Council on Clean Transportation), the electric vehicle (EV) market in the United States has grown from a few thousand in 2010 to over 315,000 electric vehicles being sold each year between 2018 and 2020.

In 2020, the EV share of new vehicle sales was roughly 2.4%, an increase from approximately 2% in 2019.

Also Read: 50 Interesting Electric Vehicle Statistics & Trends [for 2022]

There is a range of reasons people are attracted to electric vehicles, which include their low running costs. EVs are also perfect for environmentally conscious individuals because they do not emit any of the gases into the atmosphere that is associated with global warming and therefore lower an individual's carbon footprint.

With all the advantages of buying an EV over a fuel vehicle, we wanted to find out about U.S. motorists' views and preferences concerning electric vehicles. We, therefore, conducted an in-depth survey of 2,000 U.S. motorists exploring all things EV-related.

U.S Motorists' Views & Preferences Concerning EVs

What Types of Vehicles Are Consumers Considering for Their Next Purchase?

The types of vehicles respondents of the survey are considering for their next purchase are hybrid vehicles (30%), gas vehicles (27%), and all-electric vehicles at 25%. Finally, 16% answered that they are not intending to purchase a vehicle soon.

From investigating regional differences, the Southwest was the area most likely to consider buying an EV at 33%, followed by the Midwest at 27%, and finally the Southeast at 25%. Conversely, the Southwest (37%) and Northeast (33%) were the regions that were most likely to respond in the survey that they are considering buying a gas vehicle.

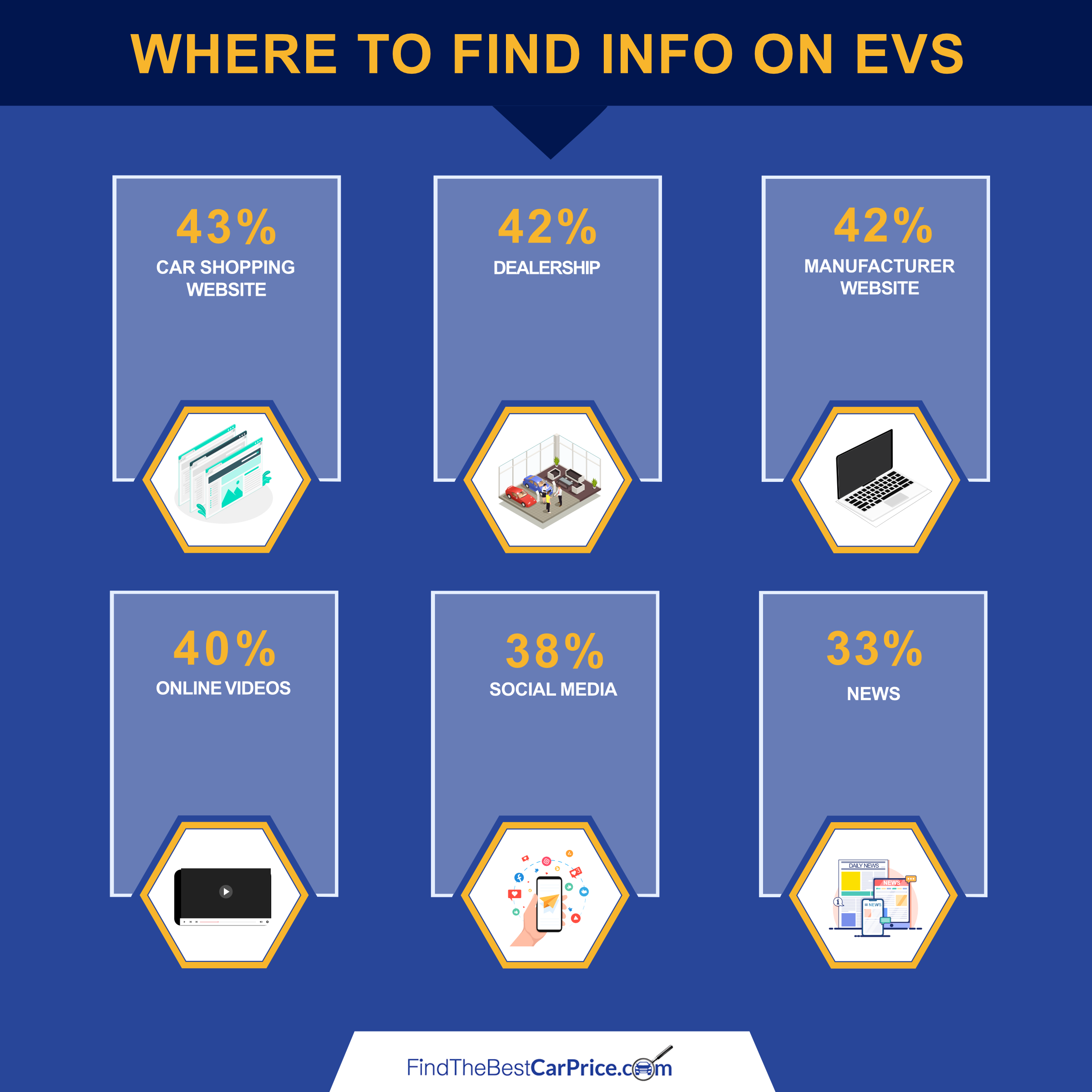

Where Do Consumers Get Information on EVs?

Interestingly, just over a quarter (26%) answered that they do not look for information before purchasing a car.

Nearly half of those questioned (43%) answered car shopping websites, dealerships (42%), manufacturer websites (42%), online videos (40%), social media (38%), and finally the news (33%).

The Midwest is most likely to find EV information in a car dealership (44%), the Northeast also in a car dealership (49%), the Southeast is on car shopping websites (45%), in the Southwest, it's both on car shopping websites and online videos (51%) and finally the West is most likely to not look for information at all regarding EV’s (38%).

What Is the Preferred EV Body Type?

The survey also explored what all-electric vehicle body types would be the first choice for survey respondents to buy:

- SUV (24%)

- Sports Car (18%)

- Sedan (15%)

- Hatchback (11%)

- Minivan (9%)

- Truck (8%)

Interestingly, 43% of the youngest age demographic, the 18 to 24-year-olds, would like an SUV body type compared to 0% of those aged 65 or above. Additionally, only 13% of 18 to 24-year-olds would like a sports car, compared to nearly half of those over 65 (48%).

Furthermore, only 18% of females in the survey answered they would like an SUV body type compared to nearly double the percentage of males (32%).

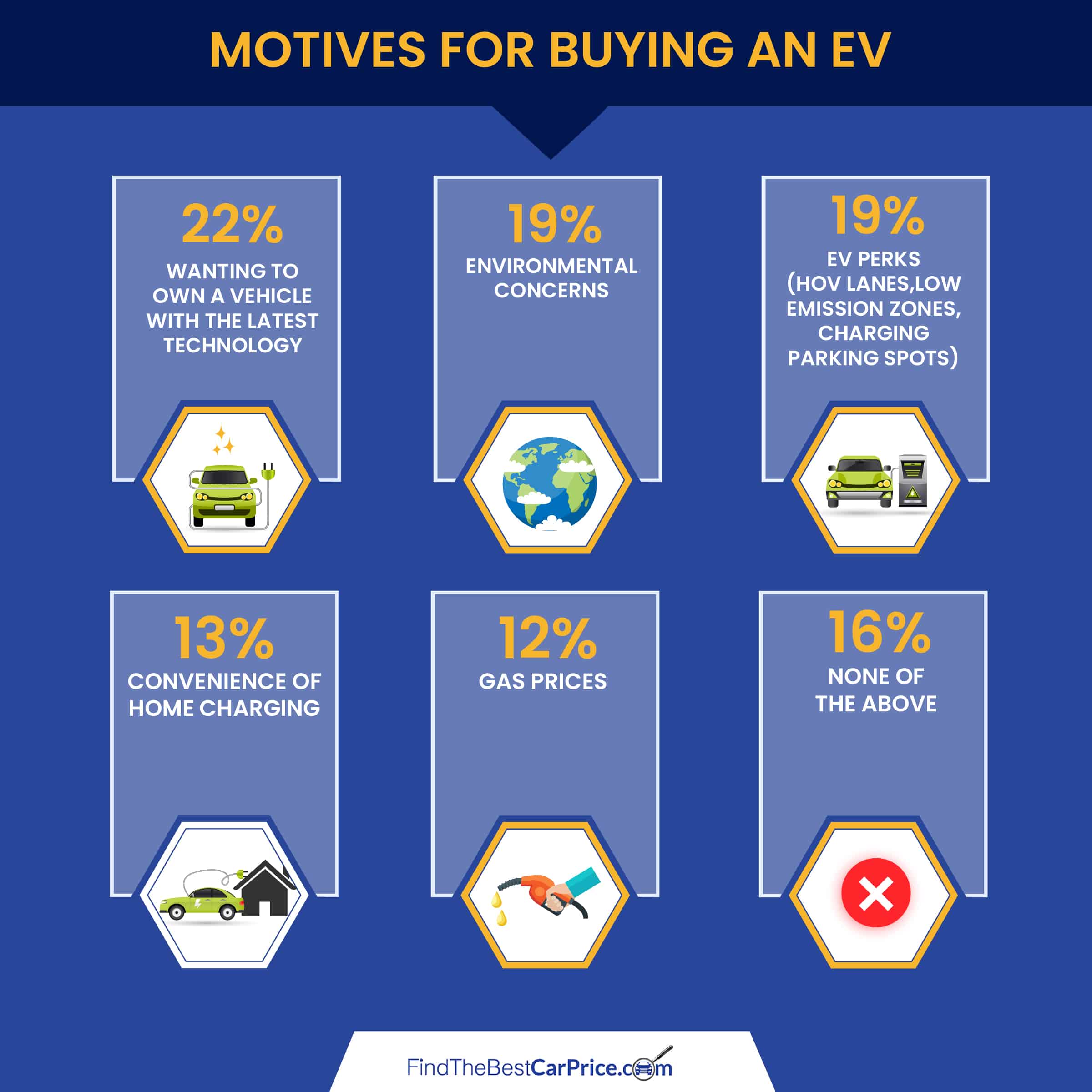

What Makes People Buy an EV?

The top three most important motives surveyees have for buying an EV were being able to own a vehicle with the latest technology, environmental concerns, and the perks that come with owning an EV.

It is interesting to note that despite the U.S. experiencing record-breaking gas prices, only 12% of those surveyed answered that gas prices were a motive for buying an EV. The full breakdown can be found in the below table:

Interestingly, when exploring survey data regarding age, those aged 65 and above were much more likely to buy an EV because of environmental concerns than those aged 18 to 24 at 52% and just 17% respectively. This goes against the long-held belief that generation Z (people in their teens to mid-20s) are always much more concerned than older generations about the environment.

In fact, the survey found the main reason those aged 18 to 24 are considering buying an EV is because of the perks associated with having this type of car (HOV lanes, Low-Emission Zones, and Charging Parking Spots). This figure is just 9% for those aged 55 and above.

How Do Consumers Shop for an EV?

The top ways people prefer to purchase all-electric vehicles were also investigated. The top three ways respondents favor purchasing EVs were mostly online, but the final purchase in-person (46%), entirely in-person (19%), and in third place was completely online with delivery (17%).

Unexpectedly, over half (55%) of those aged between 55 and 64 would buy their electric vehicle completely online with delivery, compared to just 13% of 18 to 24-year-olds.

Males are also more likely than females to purchase their EV mostly online but ultimately buy in-person at 58% and 37% respectively.

Additionally, if we look at regional percentages, just under a third (29%) of those in the Midwest would buy an EV completely online with delivery, compared to just 9% of those in the Northeast. Conversely, a quarter (24%) of respondents in the Southwest would only purchase an EV in-person as opposed to only 13% in the Midwest.

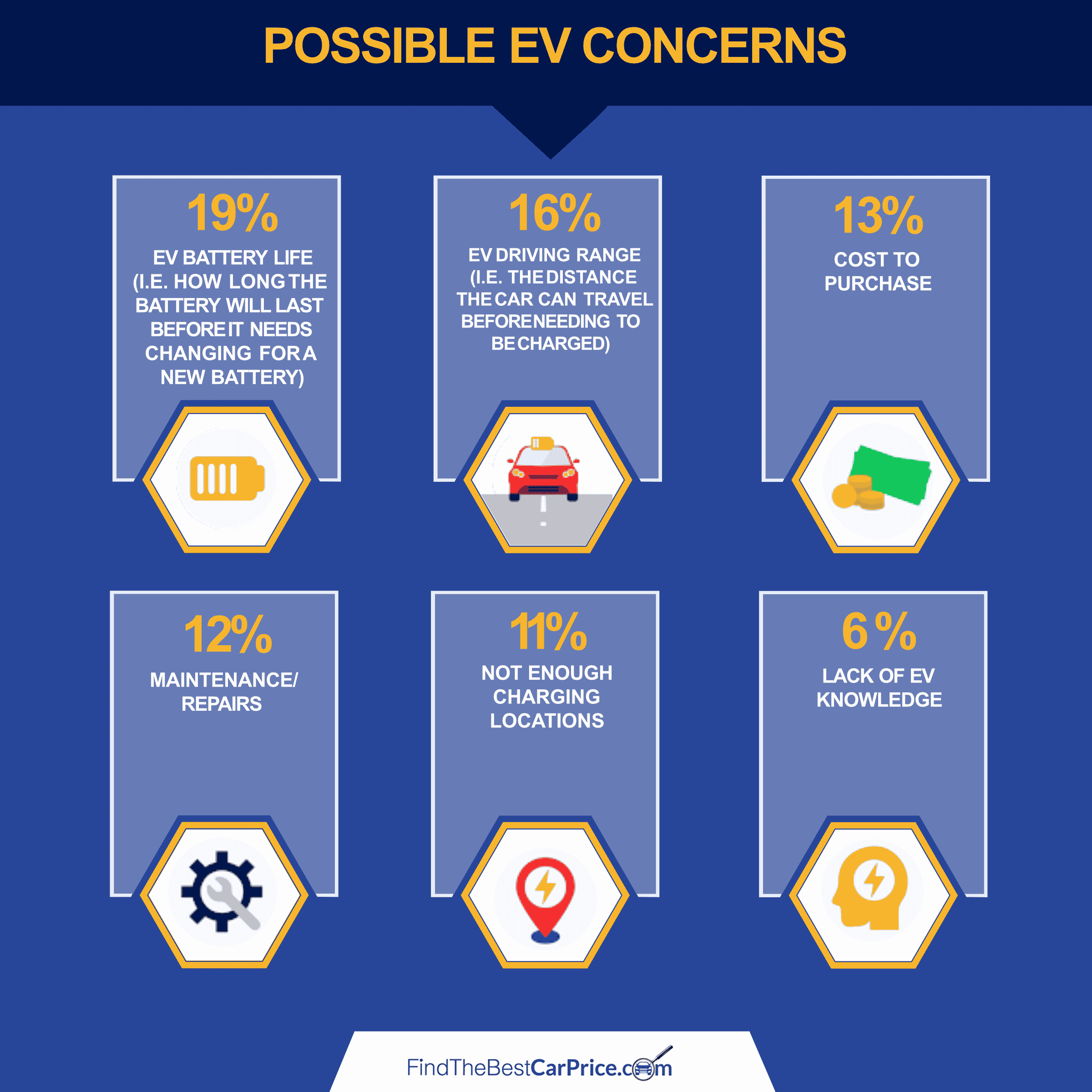

What Stops People From Buying an EV?

Choosing your next vehicle can be a huge decision, so viable concerns regarding owning an all-electric vehicle were also explored. Interestingly, 22% of those polled do not have any concerns regarding buying an EV, which suggests consumer fears about electric vehicles are subsiding. Conversely, for those who had concerns, the following table highlights these:

Where Can You Charge Your EV?

The ability or inability to charge electric vehicles from home can make or break one's decision to buy an electric vehicle. Therefore, the survey investigated whether U.S. motorists have the infrastructure to charge an all-electric vehicle from their home if required. 40% answered that they could, 37% said they couldn’t and finally, 23% were unsure if they could or couldn’t.

When investigating regional data from the survey, it was revealed that half of those in the Northeast have the infrastructure to charge an all-electric vehicle at home compared to only 30% in the Midwest.

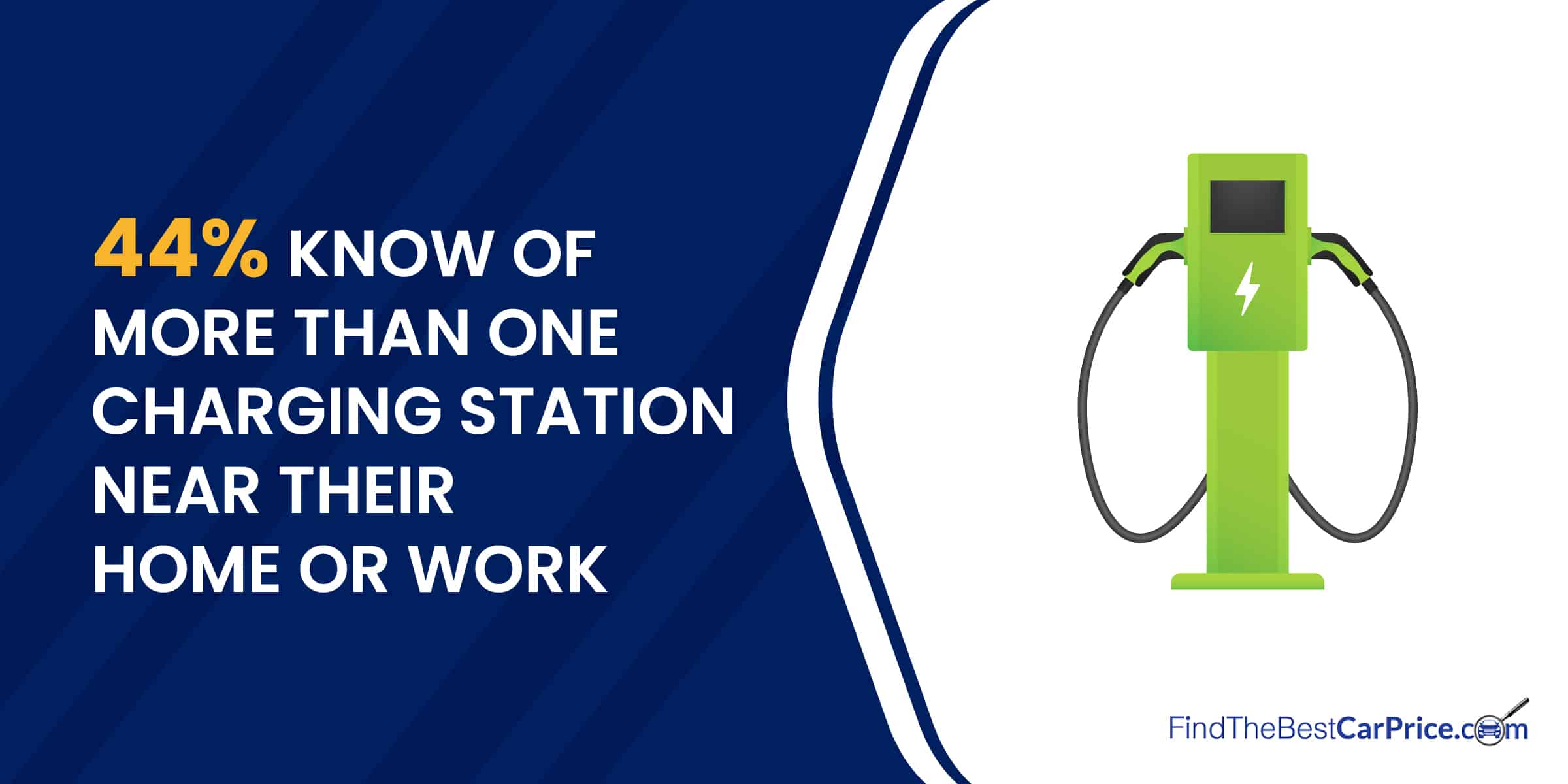

Another question that the survey investigated was whether respondents knew the location of any public all-electric vehicle charging stations near their home or place of work. (This excluded any charging facilities at home).

23% responded they were aware of one EV charging station, 44% answered that they knew more than one charging point and finally 30% of those polled didn’t know of any near their home or place of work.

The survey also reveals that slightly more males than females are aware of the location of more than one public all-electric vehicle charging station near their home or place of work at 48% and 41% respectively.

What About the Federal Electric Vehicle Tax Incentive?

According to the US Department of Energy: “All-electric and plug-in hybrid vehicles that were purchased new in or after 2010 may be eligible for a federal income tax credit of up to $7,500.”

It is important to note, however, that the amount you qualify for is based on both your income tax and the size of the electric battery in your EV.

The survey, therefore, asked respondents if, before taking this survey, they were aware of the Federal all-electric vehicle tax incentive. It was revealed that the percentages were fairly balanced, with 43% answering that they knew about the incentive and 37% responding that they didn’t. The rest of those surveyed said they were unsure.

From exploring gender, a greater percentage of males are aware of the federal all-electric vehicle tax incentive than females at 52% and 35% respectively.

Finally, the region that was most likely to be aware of the Federal all-electric vehicle tax incentive was the Northeast at 55%. Conversely, the regions that were least likely to be aware of the incentive were Southeast and West at 40%.

Final Thoughts & Takeaways

Although there are still concerns, the EV market is growing exponentially and positive attitudes toward EV adoption highlight this.

If you're looking to buy an electric vehicle, then look no further than FindTheBestCarPrice.com. You can learn how to buy a car at the best possible price and get prices from multiple car dealers.

Because of the large range of EV options available, we have also put together this blog post to explore which are the best EVs in different categories.

Methodology: We surveyed 2,000 motorists between 04/01/2022 to 04/11/2022.

Best EV Deals by Type

Posted in Car Buying Tips, Electric and Hybrid Vehicles |