52 Interesting Electric Vehicle Statistics & Trends [Updated for 2024]

January 15, 2024

Steve Birkett is an electric vehicle advocate based in Greater Boston, Massachusetts. He is a content creator and marketing professional who contributes written and recorded pieces to a wide range of media outlets. His analysis has been featured in Find The Best Car Price, WWLP TV, and Torque News, among others. He has also had video content featured on Inside EVs. Birkett was an EV Guide for Plug in America events in Massachusetts (Drive Electric Cambridge and Drive Electric Lowell) and Ohio (Earth Day 2019 at Cleveland Zoo). He participates in quarterly advisory panel meetings for EVolve New York (a state-level charging initiative) and has contributed to focus groups for prominent U.S. charging networks.

Birkett is a father-of-two who loves nothing more than packing up the family and hitting the road in their latest electric car, which is currently a 2022 Hyundai IONIQ 5. With multiple Chevy Bolts in his past, as well as a Chevy Volt and Tesla Model 3 LR in the extended family, plus various EV rentals when he ventures back home to his native United Kingdom, Birkett has more than 100,000 all-electric miles under his belt and is always ready to try out a new electric vehicle.

For press inquiries, contact steve@findthebestcarprice.com

Curious about cool, eco-friendly vehicles? You're in the right place.

Discover the most exciting facts about buying electric cars this year. Learn about the latest trends, buyer preferences, and why electric cars are increasingly popular.

Thinking about an electric car? Our clear, easy-to-understand stats will show you the 2024 electric car scene.

Check out our updated list of general car buying statistics and trends for 2024 >>

Table of Contents

Need an expert quote for your story? We’re happy to help. Contact our Senior EV Editor Steve Birkett.

Key Electric Vehicle Statistics

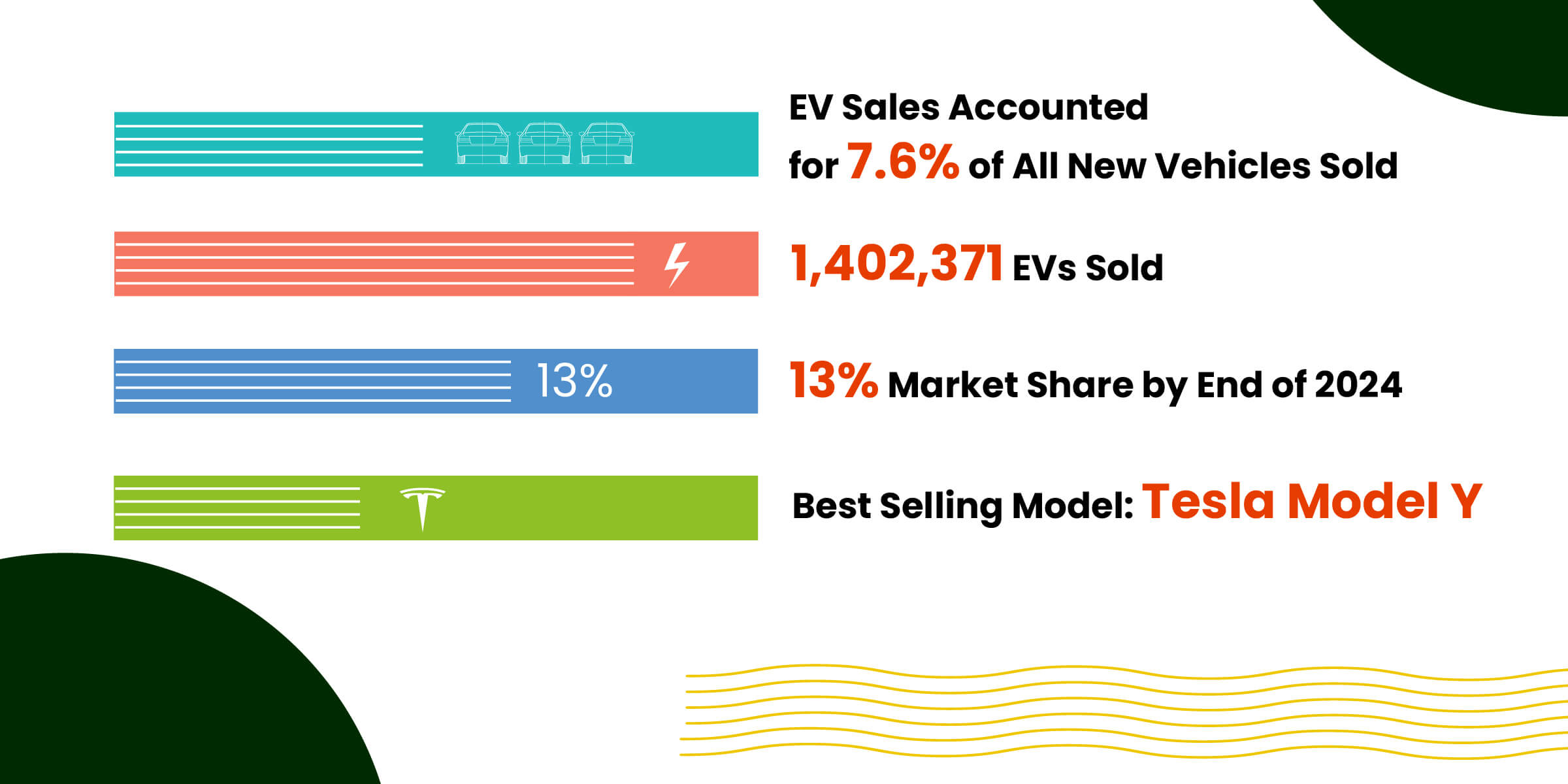

- Electric car sales accounted for 7.6% of all new vehicles sold in the US in 2023, up from 5.6% in 2022.

- 1,402,371 PHEVs and BEVs were sold in 2023.

- The total number of battery electric car (BEV) registrations during the first nine months of 2023 amounted to 852,904, which is about 61% more than a year ago.

- J.D. Power analysts are expecting the market share of EVs in the U.S. to reach 13% market share by the end of 2024 and 24% total market share by 2026.

- Under The Inflation Reduction Act, eligible EVs could qualify for a $7,500 tax credit if they meet the requirements of being built in North America and having sourced critical battery materials from the U.S. or free trade agreement countries.

- Global sales of fully electric and plug-in hybrid vehicles (PHEVs) rose 31% in 2023.

- The best-selling EV in 2023 was the Tesla Model Y, with 394,497 US sales.

- This year, there are over 40 battery-electric vehicle models available in the US.

EV Sales and Battery Statistics

How many EVs are being sold? What manufacturers are selling the most?

And what the heck is going on with the batteries for these futuristic vehicles?

Let’s check out these sales and battery stats.

- Tesla’s stock has fallen 13% in January 2024 alone.

- China currently hosts as much as 90% of the global production of some key components for batteries.

- Atlas Public Policy recently tallied all the announced projects located in the United States and concluded that there were more than $128 billion of total announced investments into electric vehicle plants, battery plants, and battery recycling.

- In 2022 alone, companies announced more than $73 billion in planned projects for electric vehicle battery creation.

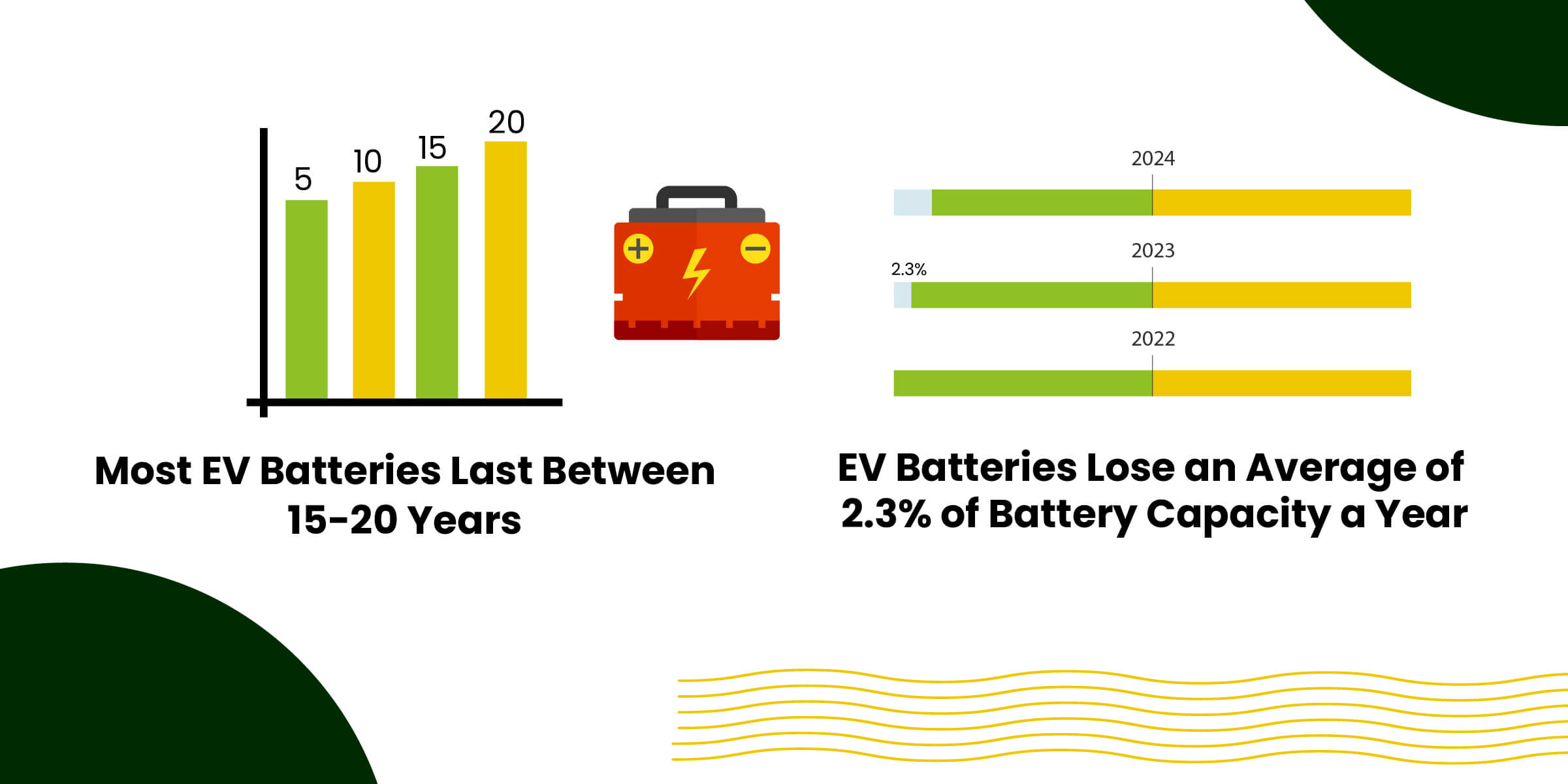

- Under current estimates, most electric car batteries will last somewhere between 15-20 years before they need to be replace.

- When asked what makes them hesitant about purchasing an electric vehicle, the fear that a battery will die is an important worry cited by 33% of potential EV drivers.

- EVs are currently estimated to lose an average of 2.3% of their battery capacity per year.

- Almost all EV manufacturers offer around 8-10 years warranty for their battery pack.

- China will make up 57% of total sales in 2024, with 6.8 million sold units.

- Level 1 charging equipment provides charging through a common residential 120-volt (120V) AC outlet. Level 1 chargers can take 40-50 hours to charge a battery electric vehicle (BEV) from empty and 5-6 hours to charge a plug-in hybrid electric vehicle (PHEV) from empty.

- Level 2 equipment offers charging through 240V (in residential applications) or 208V (in commercial applications) electrical service, and is common for home, workplace, and public charging. Level 2 chargers can charge a BEV from empty in 4-10 hours and a PHEV from empty in 1-2 hours.

- Direct current fast charging (DCFC) equipment can charge a BEV to 80 percent in just 20 minutes to 1 hour. Most PHEVs currently on the market do not work with fast chargers.

EV Car Buying Consumer Behavior & Trends

What are EV buyers looking for in a car? Are people staying loyal to EVs once they purchase their first one?

And what’s the general attitude of consumers towards electric vehicles in general?

While popularity and interest have certainly increased in the last year, there are still a good amount of folks who remain hesitant about the possibility of driving an electric vehicle. Skeptics cite concerns about a lack of charging stations and battery longevity as the top reasons why they won’t be buying an EV just yet. (Also, they’re still more expensive upfront.)

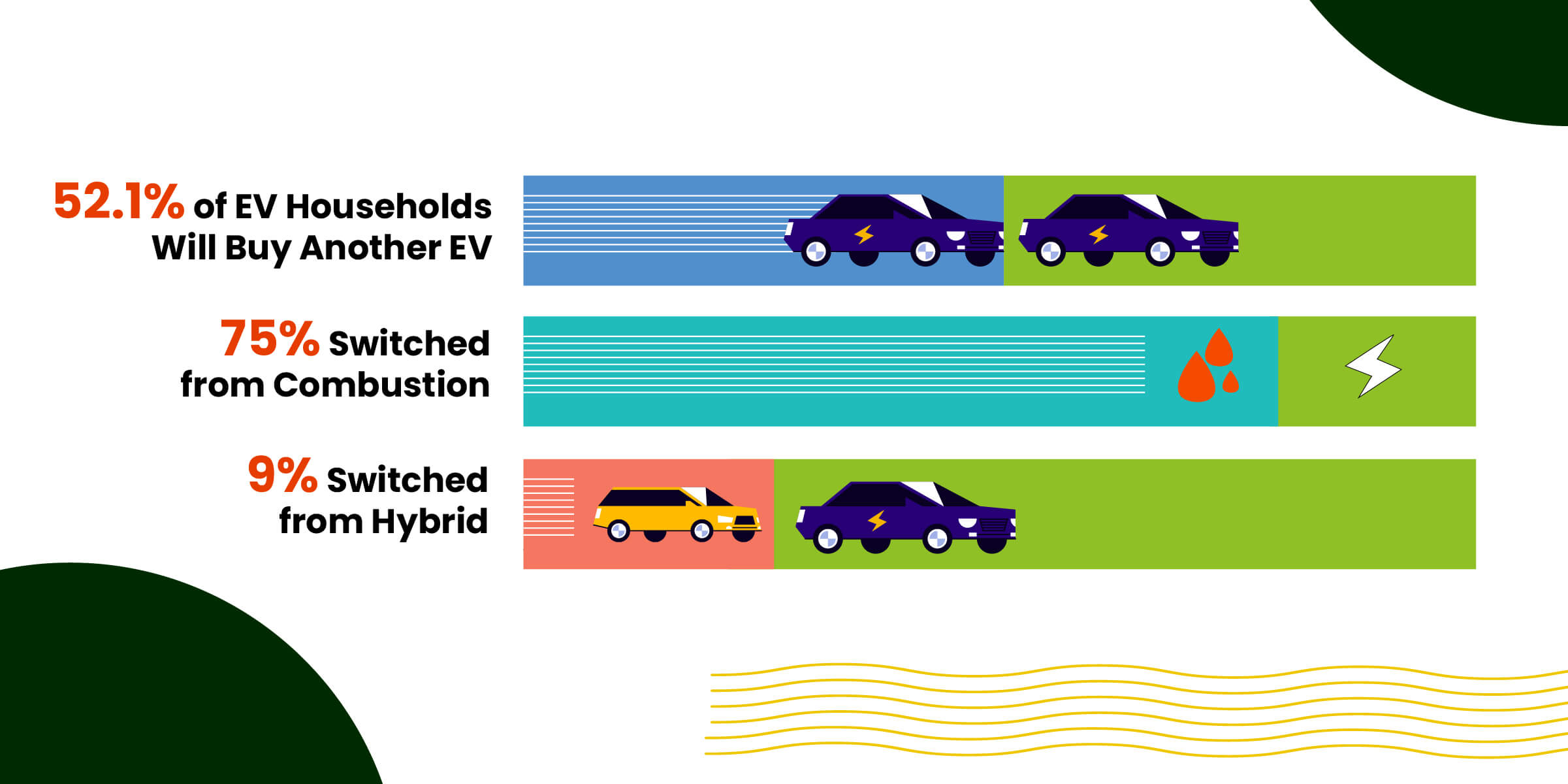

- 52.1% of EV households (excluding Tesla's numbers) buy an EV as their next vehicle.

- 3 in 4 new EVs are driven by people switching from a combustion-engine vehicle.

- 9% of recent EV buyers were already driving a hybrid.

- 49% of prospective EV owners fear being unable to find a charging station.

- According to Inside EVs, over 40% of consumers report “cost” as a reason not to buy an EV.

- More than one in four Americans say they would not consider buying an electric vehicle.

- Only 14% of respondents said they would definitely buy or lease an EV.

- 22% of respondents said they would consider getting an EV as their next car.

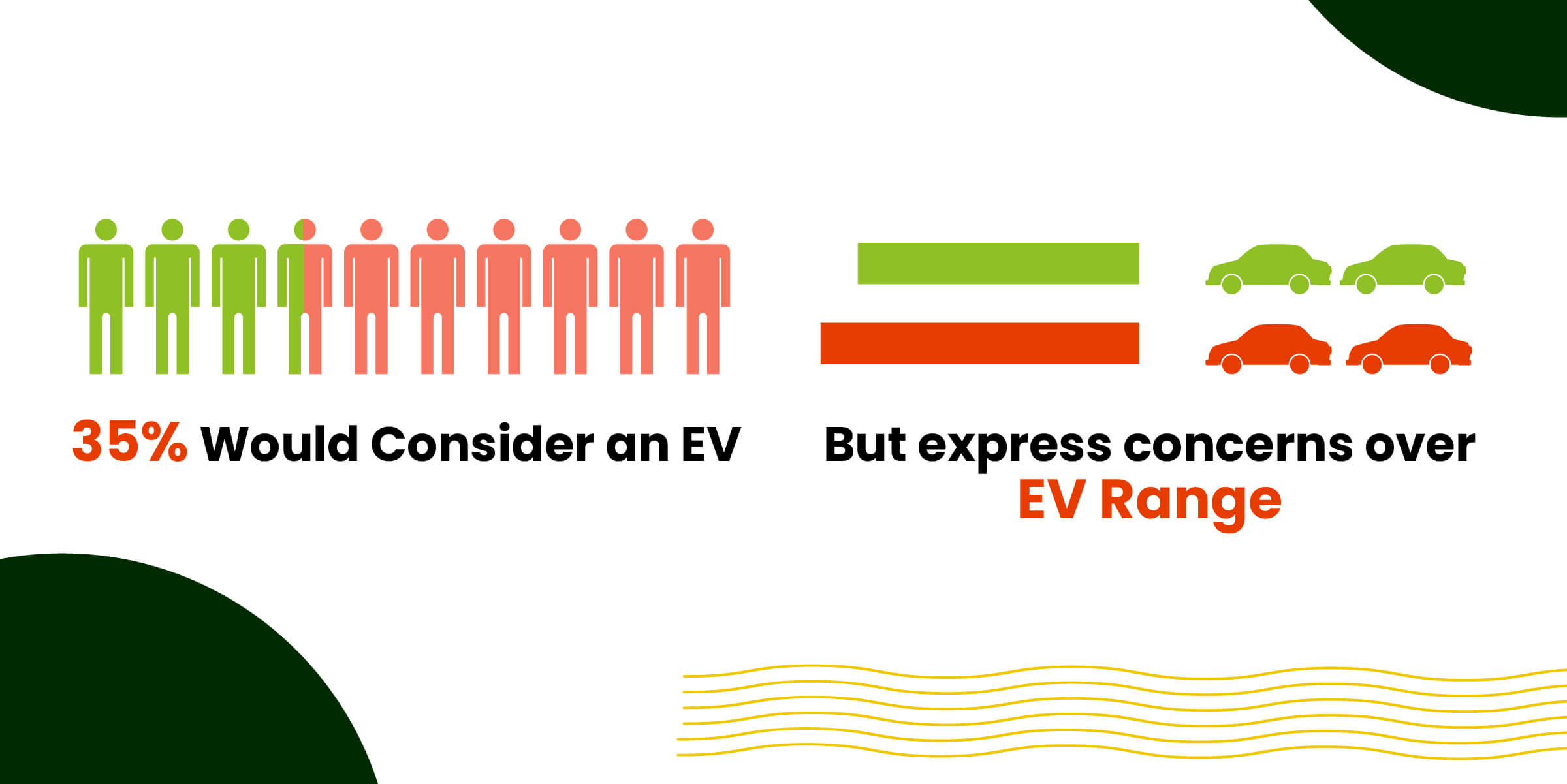

- 35% said they might consider an EV in the future.

- About 60% of those surveyed said that with electric cars, they'd have to worry about when and where they could charge their vehicle.

- About 55% of respondents also expressed concerns about the range provided by the battery of an EV.

- Almost half of all Americans surveyed (46 percent) said that they were unaware of any such government incentives for buying electric vehicles.

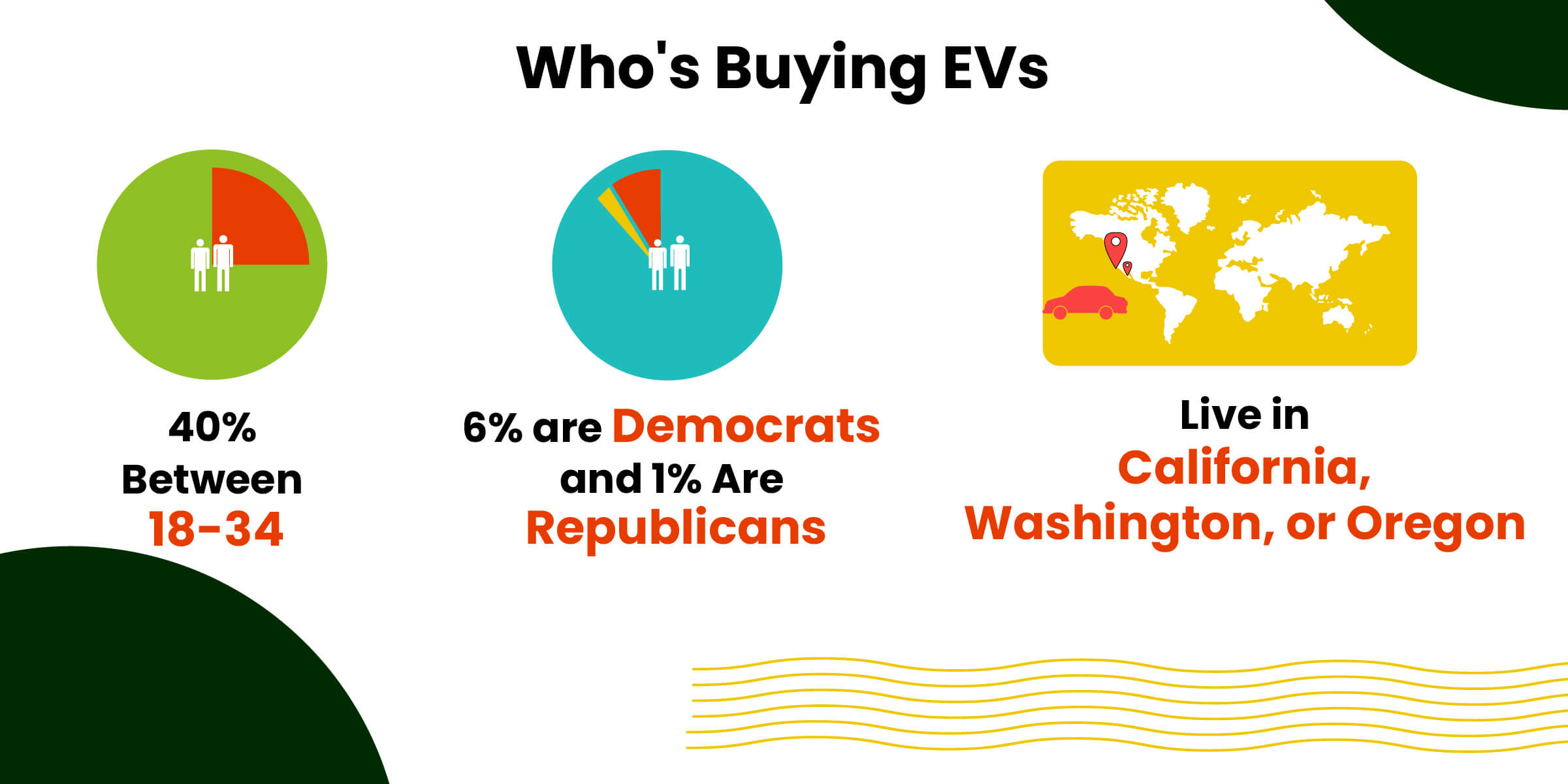

EV Demographics

Who is buying EVs in 2024?

It appears that the average EV buyer is a young adult, environmentally conscious, Democratic male living in California.

Here’s what the rest of the demographics of EV buyers look like.

- EV buyers are notably younger than average (41 years old versus 52 for all new-vehicle buyers.)

- 40% of EV buyers are aged 18-34.

- According to an Edmunds survey, 55% of men said that they like EVs versus just 22% of women.

- Electric vehicle ownership among political parties is 6% for Democrats, 4% for independents, and 1% for Republicans.

- Non-Hispanic Whites represent 41% of ICE (internal combustion engine) purchases but 55% of PEV purchases.

- Hispanic car buyers account for 38% of ICE and 10% of PEVs, and Black Americans account for 3% of ICEs and 2% of PEVS.

- The average household income for a new-vehicle buyer is $115,000, and $96,000 for a used-vehicle buyer.

- California continues to lead the nation in EV sales in 2023, with 25% of all vehicles sold being electric.

- Washington is the state that comes closest to California, with an EV share of 18%, followed by Oregon with 17%.

The Future of Electric Vehicles: EV Forecast Statistics

What does the next decade look like for the EV market? Will it continue its upward trend, or will it lose momentum?

It seems like all signs point toward exponential growth in the EV industry with government incentives and a larger, more affordable market making electric vehicles more accessible and appealing to the average consumer.

- In projections that were updated in October, the IEA said that under current government policies, it expected EVs to make up more than 25% of total global light-vehicle sales in 2030, with BEVs making up about two-thirds of sales.

- Under government policies tied to a “sustained development scenario,” the IEA projected EV sales would exceed 45% of total vehicle sales in 2030.

- China will be making over eight million electric cars a year by 2028 compared with one million” in 2020.

- Piper Sandler analyst Alexander Potter forecasts EV penetration at 94% by 2040.

- The electric vehicle global market is expanding at a CAGR of 9.82%.

- Growth from 8.1 million units is anticipated to reach 39.21 million by 2030.

- Stanford developed a machine learning program that is reducing battery testing times by 98 percent. Before this discovery, new battery technologies had to be tested for months or years to determine how long they would last. This means batteries can be produced more quickly in the future.

- SCE’s Charge Ready aims to install 50 percent of the chargers in state-designated disadvantaged communities, making EVs more accessible to a larger group of people.

- Charge Ready received a considerable boost from the California Public Utility Commission, which approved $436 million to support the installation of 38,000 charging ports over the next four years.

- California Governor Gavin Newsom’s executive order to have all vehicles sold in the state be zero-emission vehicles by 2035, meaning EV sales will skyrocket in the coming decade in Cali.

- In the next few years, over a dozen new EVs are set to be launched, including one from tech giant Apple and a few from luxury brands including BMW, Bentley, and Fisker.

Show This Year's Sources

- https://www.coxautoinc.com/market-insights/q4-2023-ev-sales/

- https://www.anl.gov/esia/light-duty-electric-drive-vehicles-monthly-sales-updates

- https://insideevs.com/news/695779/us-bev-registrations-september2023

- https://www.jdpower.com/business/resources/ev-adoption-trends-not-simple-current-dealer-inventory-might-suggest

- https://techcrunch.com/2022/12/27/an-ev-plosion-awaits-in-2023-and-itll-be-packed-with-tech/?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAAKtLTnZnB0AES3BLsRW3Z5lJ-AKNUbKK57-p4AYulTk9EyjNhbkcdw2Ng629PJLs0bhuo__rohzft978bpUEYXeoFhhze96bjecd4qBGgmX056F910Wr4gPjU15a3QtsbGkaR51As3i2r6ITdeJoIXsdFF4iPNUVN_4_yP4T502Z

- https://www.reuters.com/business/autos-transportation/global-electric-car-sales-rose-31-2023-rho-motion-2024-01-11/

- https://electrek.co/2024/01/10/best-selling-evs-2023/

- https://www.cnet.com/roadshow/news/every-ev-available-ranked-by-range/

- https://www.investors.com/news/is-tesla-stock-a-buy-or-a-sell-right-now-as-elon-musk-teases-cybertruck/

- https://www.npr.org/2022/12/30/1145844885/2022-ev-battery-plants

- https://www.npr.org/2022/12/30/1145844885/2022-ev-battery-plants

- https://www.npr.org/2022/12/30/1145844885/2022-ev-battery-plants

- https://blog.evbox.com/ev-battery-longevity

- https://blog.evbox.com/ev-battery-longevity

- https://blog.evbox.com/ev-battery-longevity

- https://blog.evbox.com/ev-battery-longevity

- https://www.canadianmanufacturing.com/manufacturing/global-ev-sales-to-hit-a-new-record-with-almost-12-million-units-and-623b-in-revenue-in-2024-297078/

- https://www.transportation.gov/rural/ev/toolkit/ev-basics/charging-speeds

- https://www.transportation.gov/rural/ev/toolkit/ev-basics/charging-speeds

- https://www.transportation.gov/rural/ev/toolkit/ev-basics/charging-speeds

- https://www.businessinsider.com/most-americans-dont-want-an-electric-car-2023-10

- https://www.nbcnews.com/business/autos/buy-ev-2024-electric-car-sales-slow-rcna132944

- https://cleantechnica.com/2022/11/22/are-the-wrong-americans-buying-electric-vehicles/

- https://blinkcharging.com/fact-from-fiction-the-real-reason-why-consumers-dont-buy-electric-vehicles/?locale=en

- https://blinkcharging.com/fact-from-fiction-the-real-reason-why-consumers-dont-buy-electric-vehicles/?locale=en

- https://screenrant.com/why-americans-dont-want-buy-ev/

- https://screenrant.com/why-americans-dont-want-buy-ev/

- https://screenrant.com/why-americans-dont-want-buy-ev/

- https://screenrant.com/why-americans-dont-want-buy-ev/

- https://screenrant.com/why-americans-dont-want-buy-ev/

- https://screenrant.com/why-americans-dont-want-buy-ev/

- https://screenrant.com/why-americans-dont-want-buy-ev/

- https://www.coxautoinc.com/wp-content/uploads/2024/01/2023-Car-Buyer-Journey-Study-Summary.pdf

- https://www.statista.com/statistics/1277794/electric-vehicle-purchase-likelihood-in-the-us-by-consumer-age-group/

- https://www.edmunds.com/car-news/whats-driving-the-gender-gap-in-evs.html

- https://news.gallup.com/poll/474095/americans-not-completely-sold-electric-vehicles.aspx

- https://escholarship.org/content/qt0tn4m2tx/qt0tn4m2tx_noSplash_36244609f162444f3e55c550dfc22cad.pdf

- https://escholarship.org/content/qt0tn4m2tx/qt0tn4m2tx_noSplash_36244609f162444f3e55c550dfc22cad.pdf

- https://www.coxautoinc.com/wp-content/uploads/2024/01/2023-Car-Buyer-Journey-Study-Summary.pdf

- https://insideevs.com/news/688779/california-tops-us-ev-adoption-25-percent-share-total-sales-h1-2023/

- https://insideevs.com/news/688779/california-tops-us-ev-adoption-25-percent-share-total-sales-h1-2023/

- https://www.marketwatch.com/story/20-ev-stocks-that-could-rebound-the-most-in-2023-11672330043

- https://www.marketwatch.com/story/20-ev-stocks-that-could-rebound-the-most-in-2023-11672330043

- https://www.nytimes.com/2021/05/04/business/china-electric-cars.html

- https://www.simplilearn.com/future-of-electric-vehicle-article

- https://www.statista.com/outlook/mmo/electric-vehicles/worldwide

- https://www.simplilearn.com/future-of-electric-vehicle-article

- https://www.simplilearn.com/future-of-electric-vehicle-article

- https://www.simplilearn.com/future-of-electric-vehicle-article

- https://www.simplilearn.com/future-of-electric-vehicle-article

- https://www.simplilearn.com/future-of-electric-vehicle-article

- https://www.caranddriver.com/news/g29994375/future-electric-cars-trucks/

Best EV Deals by Type

Posted in Car Buying Tips, Electric and Hybrid Vehicles |